PMC Property Tax Bill: If you’re a resident of Patna, you know that paying your municipal taxes can be tedious and time-consuming. But what if we told you that you can now pay your PMC Property Tax Bill online from the comfort of your home? Yes, that’s right!

Patna Municipal Corporation has launched an online payment portal that allows you to pay your taxes with just a few clicks. Not only that, but you can also download your tax receipt instantly, making the whole process hassle-free. With the pandemic still looming, avoiding unnecessary trips outside is essential. And with this new online payment system, you can do just that.

So, whether you’re a homeowner or a business owner in Patna, take advantage of this convenient and secure payment option and make your life a little easier. In this article, we’ll guide you through paying your PMC Property Tax Bill online and downloading your receipt, so keep reading!

Two types of payment methods are available to pay property tax in Bihar. The first is Online Mode, and the second is offline Mode.

Online Mode: The citizens of Patna can pay their property tax online via ‘Patna Municipal Corporation Website. Further, citizens can also pay their taxes using the ‘PayTM app’.

Offline Mode: The citizen has the option to pay their property tax through offline mode as well. For this, 6 counters have been opened in each of the total six circles of the PMC area. One counter has been opened in the PMC headquarters at Maurya Lok. Further, the citizen can call the helpline number 1800 121 8545 and contact the ‘Tax collector’ of the outsourcing agency who can come and collect property tax from the citizen’s doorstep, thus making the whole process of tax payments easier and more comfortable for the citizens.

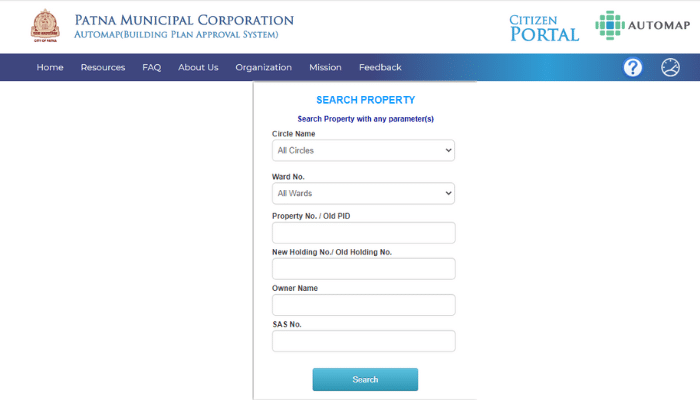

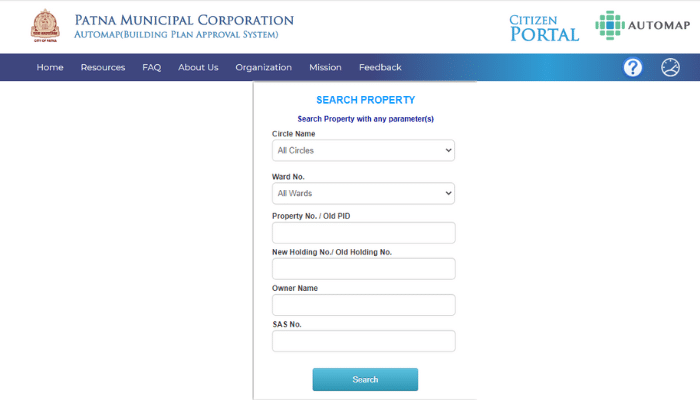

The applicant can pay his / her property tax through the following steps:

The Citizen can create his / her account on the “ Auto Tax “ portal through the following steps. The citizen should visit the official website of Patna Municipal Corporation, Government of Bihar. The official website is https://pmc.bihar.gov.in.Here users should click the Registration ( New User ) option. Follow the below steps.

The following are Mandatory fields for Property Registration:

The following are the required documents for property registration.

| Sl. No. | Type of Households | Mandatory Documents |

| 1 | Individual | Land Documents (Sale deed) |

| (New Assessed Households) | Self-attested ID Proof | |

| Self-attested Electricity Bill | ||

| 2 | Individual | Land Documents (Sale deed) |

| For legacy Households who already have a Holding number(Non-PID Holders) | Holding Receipt/Old PID Receipt. | |

| Self-attested ID Proof | ||

| Self-attested Electricity Bill | ||

| 3 | Partnership Firm | Partnership deed |

| Self-attested ID Proof of Partner | ||

| Sale deed | ||

| Self-attested Electricity Bill | ||

| 4 | Company | Certificate of Incorporation |

| (Public or Private Limited Company) | Self-attested ID Proof of director | |

| Sale deed | ||

| Self-attested Electricity Bill | ||

| 5 | Trust/NGO | Trust deed |

| Self-attested ID Proof of Trustee | ||

| Sale deed | ||

| Self-attested Electricity Bill | ||

| 6 | Government Body/Entity | Property document |

| Self-attested ID Proof of Trustee | ||

| Self-attested Electricity Bill |

Suppose the Applicant’s information and uploaded documents are true and fair. In that case, the application (SAS No) shall be approved by the concerned Circle Revenue Officer, and the Property ID will be generated immediately. The same shall be communicated to the applicant’s registered mobile number/Email ID.

The following are the details about Property Tax Calculation in Bihar.

| YEAR-WISE PROPERTY TAX RATE | ||||

| Sl. No. | Particulars | Before 1993 | 1993 to 2012-13 | Since 2013-14 |

| 1 | Property tax | 12.50% | 2.50% | 9% ( Solely Property Tax ) |

| 2 | Latrine Tax | 10.00% | 2.00% | |

| 3 | Water Tax | 10.00% | 2.00% | |

| 4 | Education Cess | 5.00% | 1.25% | |

| 5 | Health Tax | 6.25% | 1.25% | |

| Total Property Tax Rate | 43.75% | 9.00% | 9.00% | |

Through this new system, you can make a one-time payment of Rs 7,000 and avoid paying off those pesky bank fees. Registering with the Bihar Patna Municipal Corporation to pay your taxes online is fairly simple: you can log into their official website and click the link to fill in your details.

After filling in your basic details, choose the type of property you own to be registered. You also have the option to choose a physical address if you don’t have an AADHAR card. After selecting your residence, you will need to pay a one-time fee of Rs 7,000 (for a single person) using a credit or debit card (Visa or MasterCard).

The process to download and print your tax receipt is just as easy. All you need to do is log into the website and click the link to print your receipt.